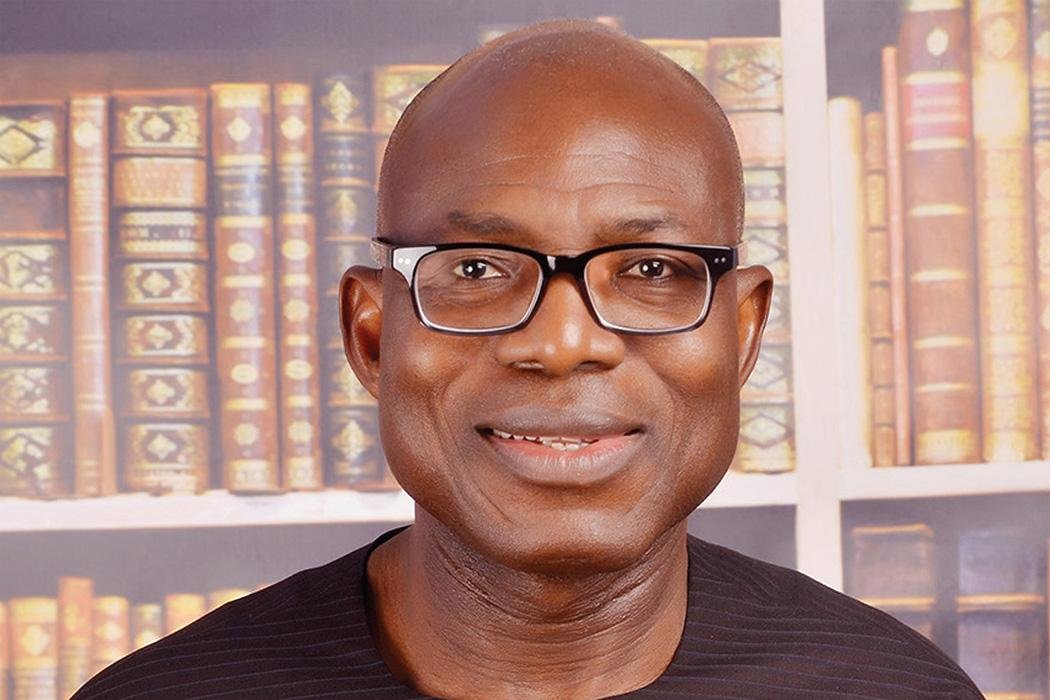

Energy and financial expert, Dan Kunle, said ExxonMobil has figured out its long term future in its recent decision to sell off its assets in Nigeria:

On the one hand, ExxonMobil says it is committed to long-term operations in Nigeria. Yet, on the other, it is selling off assets. What is the true intent of the company?

Yes, ExxonMobil’s statement of long term focus in Nigeria and their new strategic decision to divest from some of their assets in Nigeria and west Africa remains valid and in compliance with value driven investment decisions.

ExxonMobil is the number one oil and gas fortune company in the world except Aramco (Saudi State owned corporation), therefore ExxonMobil will not take a decision out of emotion and sentiment. It is a carefully thought through divestment decision.

Some of the oil assets being put up for sale are joint ventures with NNPC. What happens to the joint venture?

I’m sure ExxonMobil’s decision would have been based on the joint venture agreement of which the board of ExxonMobil must have been well informed with all necessary approvals to exit from such a joint venture arrangement.

It is also highly likely that ExxonMobil has put the other joint venture partners on notice before this public announcement.

NNPC as a partner in the joint venture is fully aware also of the provisions in the joint venture and has the right to realign and restructure the JV agreement as soon as ExxonMobil concludes their exit exercise.

NNPC may decide to operate the joint venture on their own or outsource the joint ventures to a new technical and financial partner.

They may also grant approval to the new investor/owner of the divested share of ExxonMobil, to inherit the operator ship. The caveat in this whole exercise of divestment is, that of transparency and how the processes are going to pan out in the next six months to a year.

Nigeria has missed so many opportunities to develop her railway transportation system, deep sea ports, electricity infrastructure for heavy industries and importantly skilled labour development such as you have in Mexico, South Korea, Malaysia, generally the BRIC nations

ExxonMobil is looking at raising $3bn from the sale. Are there local firms with the resources and expertise to buy and produce from these oil fields, particularly the offshore assets?

ExxonMobil must have put this estimated proceeds from the sales of this assets based on their technical knowledge of the oil and gas reserves in those oil blocks.

They must have done their portfolio evaluations and weighed all the options in the International markets. The trend in Nigeria in the last nine years has shown clearly that Shell and Chevron have divested from most of their onshore assets with so much proceeds in billions of dollars.

So it would not be a wishful thinking for ExxonMobil to have made such projections. On the issue of local investors’ capacity and appetite to acquire these assets, it will depend on the group of local investors to access funding and technical support.

The energy sector in Nigeria has not been very stimulating since 2009 because of the local conditions with our banks. Not many local investors and banks have access to long term funds (patience capital) to invest in oil and gas asset acquisitions.

It is natural for investors to look beyond Nigerian boarders and in this case investors may come from China or India, as there may be no new investors from the western segment of the world (Europe, USA and Japan) because of the obvious situation with their local economies.

Nigeria requires huge investment in human capital development. Skill and brain is what drives the new prosperity of the world

Are we likely to see more multinationals divest assets?

There is a global paradigm shift in political economic decisions. The economic zones of the world that are attracting more direct foreign investments appear to be gaining momentum from some of the multinational corporations that are reviewing their portfolios and profit margins for returns on investment.

Multinational companies are investing in China, Indonesia, Philippines, Australia, Vietnam parts of Eastern Europe and even USA.

This is largely due to the investment value driven visions of the multinationals top management decision makers. Some corporations profit centres are now in far away Indonesia, Australia or Thailand.

But not Nigeria. What may be responsible for this? The answer is the competitive enabling environment that has been created by each geopolitical economic zones of the world.

Nigeria as at today is not a competitive economy. And that is why many multinational companies cannot set up their production facilities nor sustain them.

Examples are Dunlop and Michelin tyres that left Nigeria because of lack of access to cheap rubber, and lack of stable electricity to power their plants.

Another reason why the multinationals always migrate production facilities to any competitive environment in the world is because their shareholders are after handsome dividends annually.

So, most of them find a competitive environment to set up theirs facilities for optimal returns on investment. Finally, the more Nigerian governments work towards providing a more competitive enabling environment, the less the multinational corporation will exit from Nigeria.

The energy sector in Nigeria has not been very stimulating since 2009 because of the local conditions with our banks. Not many local investors and banks have access to long term funds (patience capital) to invest in oil and gas asset acquisitions

Is it fair to say this is as a result of bad policy decisions from the government and an unfriendly business environment?

To a large extent, yes. We have had inconsistent economic and industrial development policies.

Nigeria has missed so many opportunities to develop her railway transportation system, deep sea ports, electricity infrastructure for heavy industries and importantly skilled labour development such as you have in Mexico, South Korea, Malaysia, generally the BRIC nations.

Let us take two typical examples as to why the market is not competitive and unattractive.

The first is the textile industry with which Nigeria has huge comparative advantage to grow huge cotton as the major raw material input for the textile industry but, we are no where compared to Egypt.

The second is the crude oil refinery where Nigeria has a huge comparative advantage to take crude oil from the IOC as feedstock for the refinery. But today Nigeria is importing all her petroleum products requirement.

What will a decline in investment in Nigeria’s oil sector mean for future production in the industry?

With a declining investment in the Nigerian oil sector, our future revenue from oil is threatened but having said this, does not imply that Nigeria cannot quickly attract more investment into her huge gas reserves in order to shore up the huge deficit from oil in 3-10 years’ time.

This situation brings a new opportunity for the Nigerian government to look closely and rapidly into gas value investment.

Nigeria as at today is not a competitive economy. And that is why many multinational companies cannot set up their production facilities nor sustain them

How much investment do you think the country needs in the next few years to increase production capacity as world consumption grows?

In relative terms, oil consumption will not grow as rapid as ever again. But rather, natural gas will take over. The energy supply evolution of the world from coal to crude oil and now to gas and renewable energy.

The investment required to drive Nigeria to the point where Brazil, India and United Arab Emirates are today cannot be less than 15 billion dollars capital expenditure per year.

Nigeria needs huge and massive investments in gas exploration and production, gas processing plants and electricity production, electricity transmission as well as heavy industrial productions.

Nigeria requires huge investment in human capital development. Skill and brain is what drives the new prosperity of the world.

But this new knowledge economy can only thrive on solid physical infrastructure like good roads, deep sea ports, good aviation industry and optic fibre homes.

The totality of this investment is going to run into billions of dollars on an annual basis and must be consistent for 10-15 years if Nigeria is to be anywhere near South Africa or Dubai or China.

Finally with all this projections and good governance, the required capacity will emerge to drive the prosperity of the Nigerian people. It requires a lot of work and commitment.