The Central Bank of Nigeria (CBN) and the Nigerian Communications Commission (NCC) on Monday announced new charges for customers for the Unstructured Supplementary Service Data (USSD) services.

The new price of N6.98 takes effect from Tuesday March 16 (today).

The two regulators announced this new price regime in a joint statement issued on Tuesday and signed by the and NCC’s Public Affairs Director, Dr. Ikechukwu Adinde and the CBN’s acting Director, Corporate Communications, Mr. Osita Nwanisobi.

According to the statement, USSD services for financial transactions conducted at Deposit Money Banks (DMBs) and all CBN-licenced institutions would henceforth be charged at a flat fee of N6.98 per transactions.

It also stated that said the new fee was part of the agreement reached on Monday during a meting of MNOs, DMBs (represented by the Chairman, Body of Bank CEOs) and the sector regulators – Central Bank of Nigeria (CBN) and Nigerian Communications Commission (NCC).

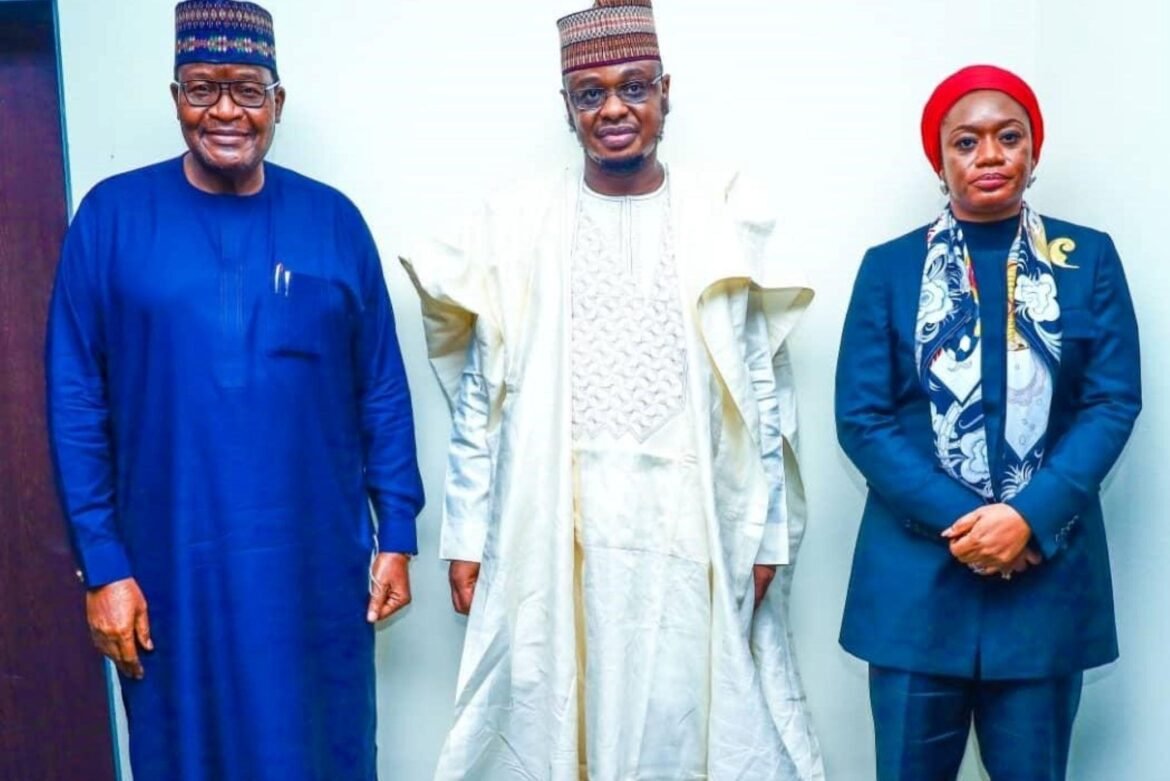

The meeting was chaired by the minister of Communications and Digital Economy, Prof. Isa Ali Pantami.

It said, “This replaces the current per session billing structure, ensuring a much cheaper average cost for customers to enhance financial inclusion.

“This approach is transparent and will ensure the amount remains the same, regardless of the number of sessions per transaction.

“To promote transparency in its administration, the new USSD charges will be collected on behalf of MNOs (Mobile Network Operators) directly from customers’ bank accounts.

“Banks shall not impose additional charges on customers for use of the USSD channel.”

The statement said the new charges was part of the agreement reached when banks and telecommunication operators met on Monday to discuss the N42 billion debt owed mobile operators by banks.

It added that plan for outstanding payments incurred for USSD services, previously rendered by the MNOs, was being worked out by all parties in a bid to ensure that the matter was fully resolved.

“MNOs and DMBs shall discuss and agree on the operational modalities for the implementation of the new USSD pricing framework, including sharing Application Programmes Interface.

“DMBs and MNOs are committed to engaging further non-strategies to lower cost and enhance access to financial services.

“With the above resolutions, the impending suspension of DMBs from the USSD channel is hereby vacated.

“Therefore, DMBs shall no longer be disconnected from the USSD channel,” it said.

The statement reminded the general public that the USSD channel was optional, as several alternative channels such as mobile apps, internet banking and ATMs may be used for financial transactions.

“The CBN and NCC shall continue to engage relevant operators and all stakeholders to promote cheaper, seamless access to mobile and financial services foe all Nigerians,” it stated.