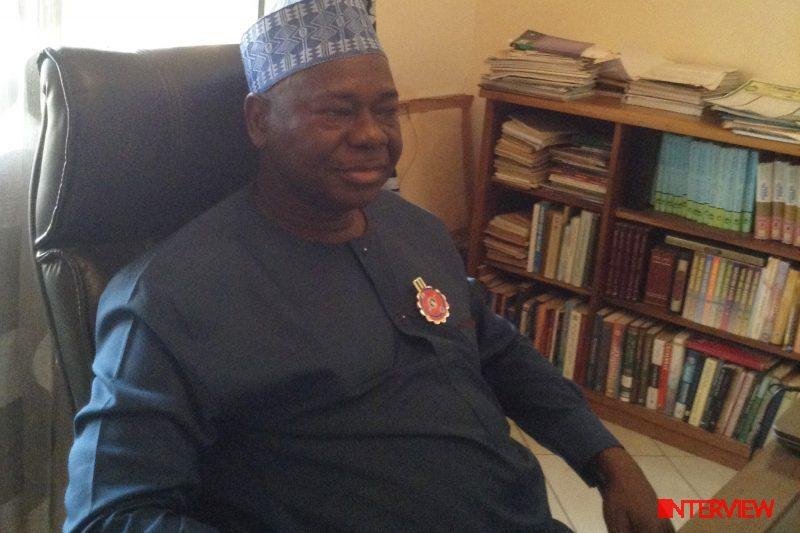

Former deputy director of Central Bank and Board Chairman of the University College Hospital, Ibadan, Ibrahim Bako Shettima, spoke on a wide range of issues from the government’s diversification agenda to how Lagos can be Africa’s financial services capital

Buhari promised to diversify the economy. After three and a half years, do you think he has succeeded?

I must say that before you make an objective assessment of the diversification drive of the present government, you have to look at where we were before 2015. At the time the Buhari government came in, the economy was suffering from lack of liquidity, the international oil price was dwindling, coming down at a very fast pace and therefore, the foreign reserve was also coming down at a very fast pace.

In fact, as at 2017, foreign reserves were just about $27billion compared to the high of $60billion we had some years earlier. In the quest to diversify the economy in order to cushion it from such crisis, the government put in place, policies that will shore up the contribution of agriculture to the GDP, since oil could not be relied on.

We are all witnesses to the fact that one very important headline policies of the government is the Anchor Borrowers Scheme, which has led to massive reduction in the importation of rice and also replaced by local production. We are also aware that by way of a complimentary policy, the Central Bank has liberalized the forex market in such a way that exporters and investors’ windows have been opened, thereby giving incentives for exporters to repatriate their proceeds.

You can see that while the fiscal measures were ongoing, the monetary side was also supporting it by diversifying the sources of forex, instead of relying on oil. Non-oil exports, which otherwise was not performing to expectations, have picked up.

That is why today, we can boast of over $40billion in foreign reserves. But when we are talking of diversification, it involves not just diversifying the sources of foreign reserves. It also involves diversifying the sources of internal revenue and other economic activities.

If you talk of intensive diversification, it will be within the already existing product range that are expanding. But if you talk of extensive diversification, it means new products are being introduced. In 2016, during his first budget speech, President Buhari said that SMEs and agriculture would be given priority.

Of course, through the lending activities of the Central Bank and the commercial banks, SMEs are being propped up. It is a deliberate effort to diversify the economy away from reliance on oil to other sources of local revenue and foreign reserves. So, I will say by and large, the government is on track in that objective.

On the diversification of domestic revenue, many economists believe that the government is failing. Some are calling for an increase in VAT and new forms of taxation. Would that help the economy?

For you to conclude that the government is failing, you have to have information on what the revenue was before 2015, what it is today, and the projection for the future. I believe, for the first time, the Federal Inland Revenue Service, the Customs Service are at their best in trying to increase the revenue.

Just a couple of days ago, FIRS came with a report that they have been able to raise a total of N5.08trillion in revenue and they are projecting that in 2019, they can raise it to N8trillion. Similarly, the custom service has promised to exceed their N2trillion rake in from 2018. I will not necessarily support raising VAT.

Rather, I would advocate for expansion of the tax net. There are some leakages and there are some areas not covered by the existing tax regime. Yes, I agree that the VAT rate in Nigeria is relatively low. But beyond that, the government tax to GDP ratio, which is the most important indices for measuring the performance of internal revenue, is below six per cent; while our peers in Africa, like South Africa, Ivory Coast and Ghana are on the international benchmark of 16 per cent.

So, we need to do a lot more to reach that international benchmark of 16 per cent. But at least we should move away from the six per cent it has been for a long time. Why we are on the six per cent is because, like I said earlier, the collection has not brought a lot of people into the tax net. Look at the informal sector. I don’t think there is aggressive tax drive in that area and we need to do more.

I am not surprised that Nigeria is not signing on immediately to CFTA because we are not even on the same page with our ECOWAS brothers on the EU EPA agreement. That is in character with Nigeria. But I believe we need to change.

Today, a lot of states cannot pay salaries of civil servants. This brings into focus, the current revenue sharing formula that’s heavily skewed in favour of the federal government against states and local governments. Is it time to review the sharing formula?

I don’t believe that a lot of states cannot pay salaries. If you say some states cannot pay salaries, there are some states that are notorious for salary arrears. I don’t want to mention names, but I don’t think they are more than five out of the 36 states we have in the country.

Having said that, revenue sharing formula should not be adjusted in isolation of other factors. It is not only because states are relatively insolvent. In the first place, states need to look inwards. Just like we said, the federal government should look at its tax administration to improve collection.

The states also have to look at the IGR. I know of a study that was done by one of the magazines in 2017. Only about 10 states in the country were beyond 10 per cent of IGR to total revenue ratio, with Lagos and Ogun coming tops. About 14 states were below the 10 per cent level.

So, they are very weak on IGR. And I am also aware that the Nigeria Governors’ Forum is working to create a template and sensitise the states on how the improve their IGR. I think all the state governors are keying into that. There is no need for more revenues to be granted to the states for now.

It is only when the clamour for restructuring and devolution of power becomes a reality, then, reducing the ratio of the federal government in favour of the states and local governments will be justified.

As a cartel, OPEC stood by Nigeria when we had revenue or fiscal crisis because of the shock in international oil price. And OPEC is always ready to stand by us even by collective action.

With the current state of the economy, which do you think better serves the country’s interest, growing our foreign reserves or protecting the naira?

It is a delicate balance. Growing our foreign reserves implies that we are not going to subsidise the forex market, which means we are not defending the naira. And if we don’t defend the naira, there is going to be depreciation. Now what is the state of the economy?

It is highly import dependent. We have a high marginal propensity to import. And if you have a high marginal propensity to import or the demand for import is inelastic, in the short run this demand will not change in response to changes in the exchange rate.

Recent NBS statistics have shown that unemployment is about 23 per cent. In the economy, industries are collapsing or some just only coming up now because of the central bank initiative in the forex market. An economy where you have a large army of unemployed cannot afford, at least in the short run, to grow the foreign reserves at the expense of protecting the naira.

I would rather say we should continue defending the value of the naira. It is sad that we are subsidising imports. Our appetite for import is large. But we have to do it in the short run. But I would prefer that we give a sunset clause beyond which time, we should not continue to defend the naira and allow the naira to find its value in the forex market.

I will not necessarily support raising VAT. Rather, I would advocate for expansion of the tax net. There are some leakages and there are some areas not covered by the existing tax regime.

Is it time for Nigeria to rethink where and in which currency it holds its foreign reserves?

Yes and no. I think we have to look at the direction of trade. We also have to look at multilateral agreements. For instance, we are a member of OPEC. And OPEC’s trade in oil is denominated in dollars. We have to also look at the preferences of our trading partners.

And by and large, we take into account, the liquidity of other currencies. You are talking of diversifying the currencies we hold our foreign reserves. The dollar is the predominant currency in international trade. It accounts for about 64 per cent of reserve currencies in world.

Reserve currencies like euro, Japanese yen and now Chinese yuan account for the remaining 36 per cent. Even in the EU where there is a clamor for diversification of reserves, the euro is only used in 19 per cent of international trade. But the clamour in the EU is more political, diplomatic than economic because the US is ramping up or restoring the sanctions against Iran in direct conflict of the position of Europe.

If the sanctions against Iran are ramped up, it is likely to affect EU trade with Iran. And therefore, they are currently thinking of de-dollarising, reducing their dependence of the dollar. But even they do not foresee taking a position on that in the immediate future.

So, they are looking at an interim arrangement of setting up a Special Purpose Vehicle to handle international trade between some Europeans firms and Iran, especially in energy and oil. So, for now, Nigeria’s recent swap arrangement with China relates to the first point I made. Our trade with China currently accounts for 24 per cent of our imports.

So, it may be right to have the arrangement that Central Bank entered with China in 2016 and activated last year. But it is too early in the day to assess the performance of that swap arrangement. It is something we have to tread carefully on.

There is no need for more revenues to be granted to the states for now. It is only when the clamour for restructuring and devolution of power becomes a reality, then, reducing the ratio of the federal government in favour of the states and local governments will be justified.

So, you believe Nigeria should continue to trade its oil strictly in dollars?

For now, yes. Like I said, it is better for us to remain in OPEC. As a cartel, OPEC stood by Nigeria when we had revenue or fiscal crisis because of the shock in international oil price. And OPEC is always ready to stand by us even by collective action.

If I recall, in the early stages of this administration when OPEC was reducing the production quotas for member states in order to shore up prices, Nigeria was given a waiver. So why should we now leave? In the case of oil, we will be forced to act along with OPEC. The sale of oil is denominated in dollars as far as OPEC is concerned. That is why I referred to multilateral agreements.

The Buhari government has faced criticism over its reluctance to sign the African Continental Free Trade Agreement. Does the government have any reason not to sign the agreement and is Nigeria ready to give up the naira for a single regional currency?

When you look at the trade policy of the country in general, I am not talking specifics, we still need to do a lot more about the strategic economic objective of Nigeria in engaging in international trade. What do I mean? Are we looking at the terms of trade between Nigeria and our major trading partners?

Are we looking at supporting our local industries to compete internationally? Are we looking at using trade to generate employment locally so that trade will be a significant proportion of our GDP? These questions must be answered before I can say conclusively that Nigeria is delaying in signing or not signing the CFTA.

Having said that, I also want to recall that it is not the CFTA, even the Economic Partnership Agreement (EPA) that ACP countries have with the EU, Nigeria has also been reluctant to sign. In fact, in ECOWAS, Ghana and Ivory Coast have gone ahead to sign the interim EPA agreement with the EU that gives them access to the European market for their cocoa; Nigeria has been reluctant to sign.

So, I am not surprised that Nigeria is not signing on immediately to CFTA because we are not even on the same page with our ECOWAS brothers on the EU EPA agreement. That is in character with Nigeria. But I believe we need to change. The world is not going to wait for Nigeria. We are losing opportunities as far as trade issues are concerned.

We lost opportunities in taking advantage of AGOA from 2000. We have doing the same with the EU EPA, and now the CFTA. But in general, a continental free trade area in principle implies that there will be no duty among contracting parties in the area.

Presently we have ECOWAS where we do not have duties for inter-regional trade. The same thing will apply. One of the major fears of Nigeria is that, like we are suspecting, Cotonou port is being used by third countries outside ECOWAS to bring to Nigeria and benefit from the duty-free agreement.

The same CFTA will be the door by which countries from outside Africa would bring in their products and illegally benefit from duty free treatment. So, on that scope, you can say Nigeria has a point by delaying. But all I am saying is the world will not wait for Nigeria.

Countries like Rwanda are taking the leadership role in this while Nigeria should be in the driver’s seat. You should recall that Nigeria was positioning to have the continental free trade secretariat in Nigeria. And against the background that the CFTA is not a new thing.

The Lagos plan of action and the Abuja plan of action that were signed in the late 1990s and early 2000s all provided for this. So, what have our trade bureaucrats been doing all this while without crossing the Ts and dotting the Is and bringing the pros and cons before the executive arm of government for expedited action. That is why I said we need to do more in our trade activism and trade strategising.

An economy where you have a large army of unemployed cannot afford, at least in the short run, to grow the foreign reserves at the expense of protecting the naira. I would rather say we should continue defending the value of the naira.

Trade in Africa is hampered by the difficulty in moving money freely. Let us say from maybe Lagos to Cotonou or Accra without first wiring it through Europe. How can this be addressed?

I think what we need to do in Africa is to have a financial hub in the form of an offshore financial centre. It is a clearly delineated area in the geographical space of a country where you have financial services that are not only for the domestic economy but for the international financial markets. There are some conditions that must be met.

Number one is security. Number two is compliance with international best practices. You have financial action task force that has some recommendations on how offshore financial centre should operate. Number three is for African countries to imbibe information sharing among regulators.

That is among Central Banks. Once we have a financial centre, we easily take care of settlement of transactions across the borders in Africa. Not only in West Africa but in Africa generally. We have to also look at how Dubai has done it, to have an international financial centre in such a way that they can handle transactions while America is asleep.

They are handling transactions in Europe when America is waking up. The same thing Singapore did. Why can’t we do it in Africa? I think Lagos is well suited to serve that purpose if the right incentives by the government and the right financial law are in place.